The Buzz on Frost Pllc

Table of ContentsFrost Pllc Things To Know Before You Get ThisThe Facts About Frost Pllc UncoveredA Biased View of Frost PllcWhat Does Frost Pllc Mean?The Single Strategy To Use For Frost Pllc

An accounting job takes lengthy years in education at the very least a four-year Bachelor's level, commonly adhered to by a fifth year or a Master's degree.

As an example, some might such as the concept of running their very own company but not the stress that occurs with it. If you are really passionate regarding bookkeeping, the majority of these disadvantages will certainly develop into pros! Picking a profession as an accountant can be a strong decision offered the essential duty accounting professionals play in maintaining monetary documents and preparing monetary statements, all based upon generally approved audit concepts.

Our Frost Pllc Ideas

Bureau of Labor Data, in their Occupational Expectation Handbook, suggests a strong task overview for accounting professionals. The mean wage is competitive, and the demand for these professionals has a tendency to continue to be secure, also in times of economic uncertainty. Accounting professionals work across a series of sectors and markets, consisting of exclusive businesses, federal government agencies, and public bookkeeping firms.

Accountants require strong interaction abilities, attention to detail, and analytic abilities. Job applicants considering accounting placements need to get ready for an occupation path that requires precision, analytical reasoning, and a high degree of responsibility. Audit is both a challenging and satisfying area. Aiding clients submit returns, take care of economic information, and taking control of various other accountancy related-tasks can be demanding.

The average accountant's average wage has to do with $75,000. The highest-paid 25 percent of employees make much more than this, and there is the opportunity to make 6 figures as an accountant. Certainly, this relies on the accountancy company you benefit, your education and learning, and if you have a CPA accreditation.

The Basic Principles Of Frost Pllc

Running a business often requires handling several responsibilities, and the financial aspects can be specifically challenging. This is where a specialist organization accountant can make all the difference. They can take the time off of your hands to ensure that you can invest it elsewhere. Plus, they're professionals so you can feel certain your finances are being done appropriately.

Is having the very same accountant for bookkeeping and tax obligations the finest choice? Here's why getting your taxes right the first time is vital: An expert accountant has an extensive understanding of tax obligation regulations and regulations.

Having a professional accounting professional supervising your tax obligation preparation dramatically reduces the risk of such issues. Consider this circumstance: A business proprietor tries to handle their tax obligations their explanation individually, unintentionally omitting a significant source of revenue.

Little Known Facts About Frost Pllc.

Tax obligation laws continually develop, making it challenging for entrepreneur to stay updated on the check my reference most up to date changes. Non-compliance with tax obligation regulations can cause extreme effects, including penalties and lawful consequences. An expert accountant is fluent in existing tax laws and policies, ensuring your company is fully certified. Since we've talked about the advantages of having an accountant for accounting and declaring tax obligations, allow's discover why it's advantageous to utilize the same expert for both accounting and tax obligation needs: Disparities between your publications and tax returns can confirm costly.

If discrepancies go unnoticed, you'll miss out on out on reductions, resulting in greater tax repayments money out of your pocket. With a solitary accounting professional taking care of both obligations, your income tax return can be prepared more successfully utilizing guides they maintain. You prevent the hassle of guaranteeing that multiple accounting professionals have matching economic information, and your taxes are completed faster.

For numerous companies, the fostering of remote work stands for a brand-new normal. This shift has varied effect on the means work takes place, affecting every little thing from the technologies that companies utilize to worker settlement versions. This makeover has been specifically extensive in the expert solutions industry, where the processes through which advisors and accounting professionals view it now companion with their customers have transformed drastically.

Getting My Frost Pllc To Work

Carrying out some elements of an audit interaction from another location has come to be significantly popular. It's not all smooth cruising, and there are some drawbacks to be conscious of.

Because couple of firms focus on nonprofits, it's unusual to locate the very best certified accounting professionals for any provided interaction throughout the street. Partnering remotely with a seasoned nonprofit accounting firm gives you access to the very best accountants, anywhere they occur to be situated. There are lots of benefits to working from another location with a bookkeeping company.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Kenan Thompson Then & Now!

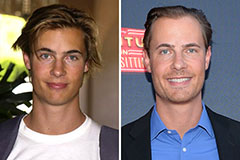

Kenan Thompson Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now!